ONE ACCOUNT – MANY POSSIBILITIES

Personal account benefits

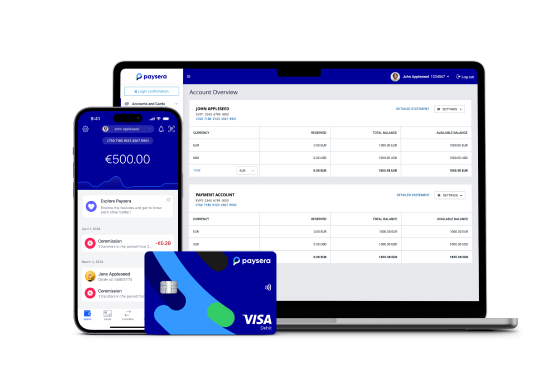

Free personal multi-currency IBAN account

Option to open a business account

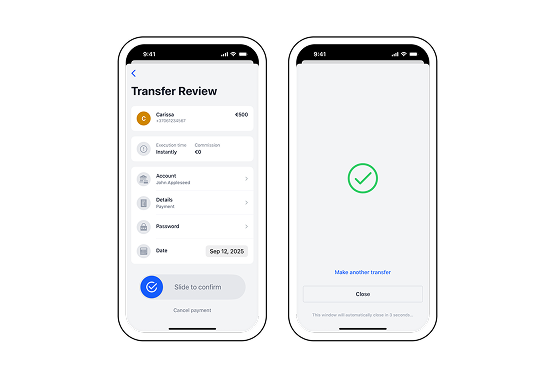

Instant SEPA transfers in euros 24/7 across Europe

Convenient and easy-to-use Super App with plenty of additional features

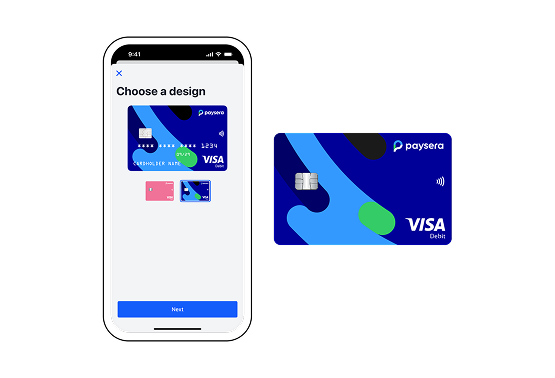

A contactless payment card for safe payments

International transfers around the world at attractive prices

Currency exchange in real-time at favourable rates

High-level security and authentication

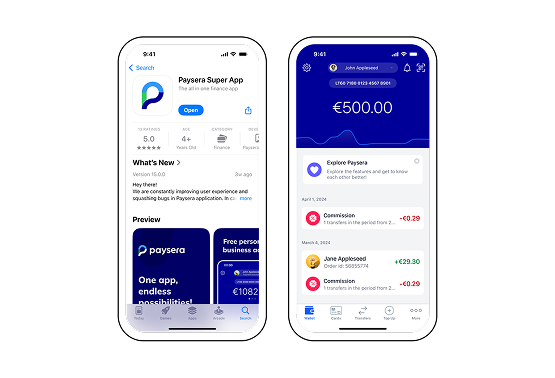

Paysera Super App – all you need, right on your phone

Fast international transfers

Contactless payment card

It’s that simple! Simply register and use it!

Forget high prices, slow transfers, and limited possibilities.

Enter a limitless world of payments with Paysera!