International transfers – send money abroad online

Send money abroad in 20+ currencies at competitive prices and manage all your money in one place – the Paysera multi-currency account.

What transfers can you make via Paysera?

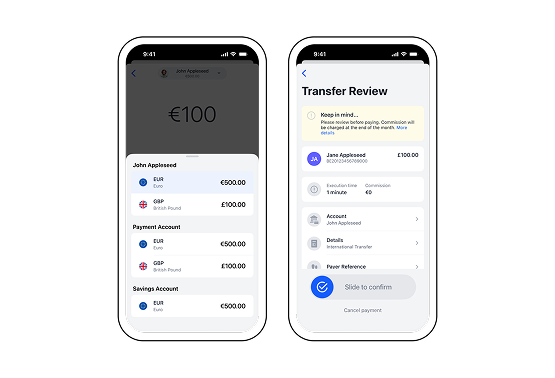

Send money online via the Paysera app or online banking

Sending money abroad has never been easier. Now you can transfer EUR, GBP, PLN and RON straight from your phone using the Paysera app.

Log in to the app > Transfers > New Transfer > Bank Transfer, and provide the required details.

If you are sending other currencies – log in to the Paysera online banking and perform the transfer via the web version.

Don’t have a Paysera account yet?

Get started >

How much does it cost to send money abroad?

Sending money abroad can be completely free, for example, if you send funds to another Paysera user or make a euro transfer to one of the EEA countries.

The fee of a transfer depends on the currency, the recipient’s country, and the bank. However, with Paysera, you will pay significantly less for international transfers than with traditional banks.

Paysera can offer competitive prices because it holds bank accounts in multiple countries, allowing international transfers to be processed as if they were local.

Fees for sending money in euros >

Fees for sending money in other currencies >

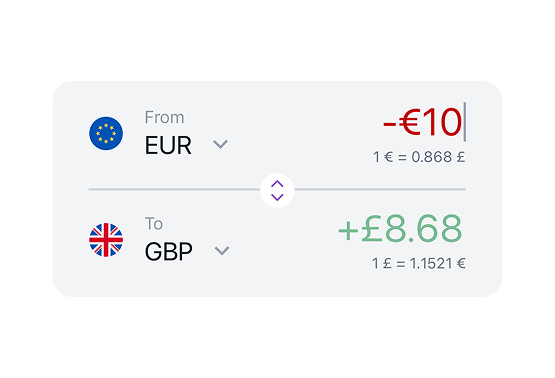

Convert currency straight in your Paysera account

Using the Paysera app you can exchange currency at great rates! Paysera's online currency exchange calculator compares exchange rates from different banks and offers Paysera customers the best one.

Frequently Asked Questions

Money transfers abroad can reach the recipient within seconds if you are performing a SEPA Instant euro transfer for example. But normally an international transfer takes up to one working day (sometimes up to 3) if you are performing it via Paysera.

When making an international transfer via a traditional bank you may need to wait a week or more.

In order to send money (and not pay a fortune in fees) from your bank account in a foreign country to your bank account in your home country, you can use Paysera as an intermediate to save time and money. The transfer you perform will look like this: from your foreign bank account > to your Paysera account, from your Paysera account > to your local bank account. If needed, you will be able to convert the currency once the money is in your Paysera account.

Step 1 – send money to your Paysera account.

Log in to the Paysera app, in the bottom menu choose Top up, select the country from which you want to send money and the currency. Use the generated instructions to perform a transfer.

Step 2 – send money from your Paysera account to your local bank.

Once the money is in your Paysera account, choose Transfers > Bank Transfer, and fill in the details. If you need to convert the currency before sending – you can also do it in the app: Transfers > Currency Exchange.

- Between your own accounts.

- Between Paysera users.

- Transfers in euro (SEPA, SEPA Instant – in European Economic Area countries, TARGET2 – in EUR outside the EEA).

- To the WebMoney system.

- International transfers in EUR, GBP, PLN and RON.

Transfers in other currencies can be performed via the web version only.