Online Currency Exchange

Don’t overpay for exchanging currencies and sending money abroad. Use Paysera's online currency exchange calculator and see the best exchange rates for you in real-time.

Exchange EUR to GBP, USD, PLN, and dozens of other currencies via our online banking or the Paysera mobile app.

Only Paysera clients can use this feature. Open an account today and start converting!

How to get the best currency exchange rate?

Private clients

Get the best rate offered by Paysera when exchanging up to 500 EUR/month.

Also, especially favourable rates apply to those who exchange more than 5,000 EUR at once. The special rate gets applied automatically.

Business clients

If your company exchanges more than 5,000 EUR in a single transaction – a better-than-standard rate will be applied automatically.

If your business regularly conducts international transactions and exchanges large sums monthly, we invite you to contact us. We'll offer you a rate that will be hard to refuse.

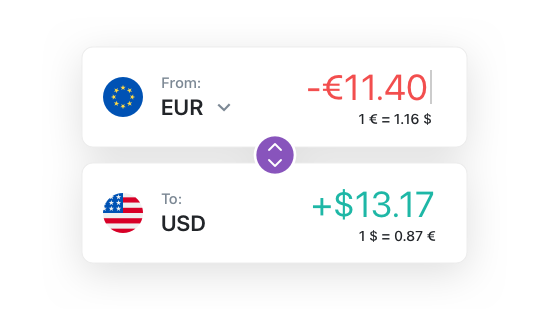

Online currency exchange calculator

To see currency rates applied to business clients, please log in to your Business Account in the Paysera system.

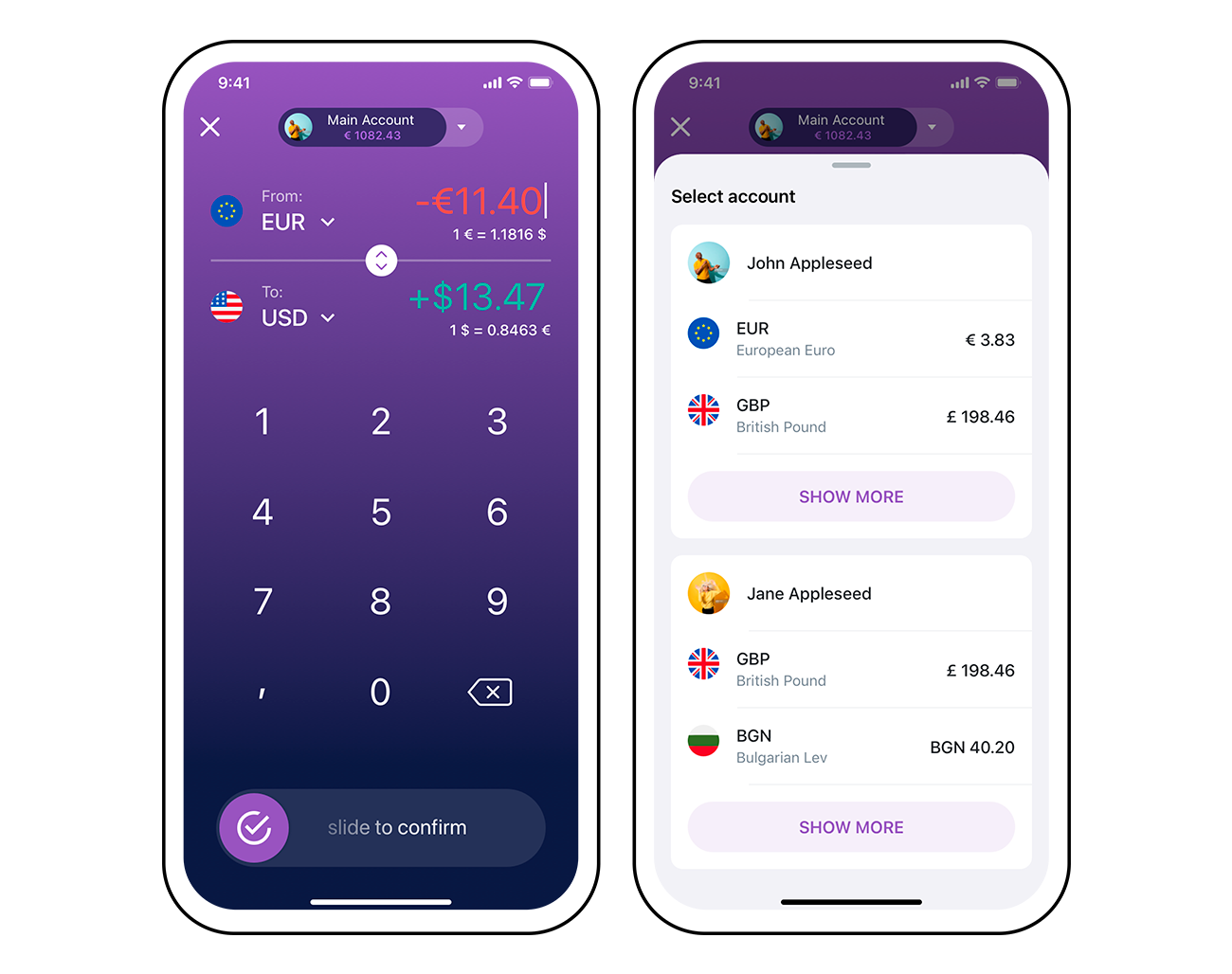

Exchange currency via the app

The best way to exchange currency with Paysera is to use our mobile app, which is free, convenient, and easy to use.

1. Open the Paysera mobile app;

2. Tap on Transfers;

3. Choose Currency Exchange;

4. Enter the currency and the amount you want to sell or buy, and confirm.

Paysera provides you with multi-currency accounts, so you can see all of your currencies in one place – the Paysera mobile app.

Exchange EUR to GBP, USD, and other currencies!

The most popular ones are EUR, GBP, USD, HUF, RON and PLN. But we also support rarer currencies like JPY (Japanese yen), HKD (Hong Kong dollar), INR (Indian rupee), and even XAU (gold) – which is not exactly a currency but buying it works just like exchanging regular money.

Frequently asked questions about online currency exchange

-

Account. You have to be a Paysera client to use the Paysera currency exchange. If you are not registered yet, download the app and open a Paysera account.

-

Top-up. Then you need to have money in your account. You can top up your account by performing a regular bank transfer in EUR, or by generating top-up instructions, if you want to send yourself money in another currency.

-

Exchange. If you have money on your account and want to exchange it – open the app, tap on Transfers, then Currency Exchange, and perform an exchange.

-

Balance. If you want to see balance in different currencies on your app, go to the main screen of your payment account, and swipe across the top balance.

If you want to send money abroad (for example not in EUR), you can either draft the transfer and choose to have your money converted automatically when sending, or first convert it into the desired currency via the app (or web), and then send it.

When using the first method, the system would convert the exact amount needed for the transfer.

Sending money abroad via the Paysera mobile app

To perform a transfer via the app go to Transfers, then Bank Transfer, enter the recipient's details, then choose the account and currency in which you want to perform the transfer. Fill out the rest of the required information and confirm the transfer.

Sending money abroad via Paysera online banking

Log in to bank.paysera.com, in the menu on the left choose Transfers > Bank Transfer, and fill out the required information.

Don’t forget to choose the desired currency and the account from which you want to perform the transfer.

Yes. You can convert currency using both the Paysera app and the online banking.

To do it via the online banking – log in to bank.paysera.com > in the menu on the left click on Currency > Currency Exchange > choose the account, the amount, and the currency. The converted funds will appear in your account immediately after confirmation.

Yes, a better exchange rate is automatically applied if you are exchanging more than 5,000 EUR in a single transaction (for both private and business account owners). And if you are consistently exchanging larger sums of money, a better rate might be offered after contacting our client support.