How to open a cumulative account for the registration of a company?

What is the cumulative account for?

A cumulative account is required to establish a new private company in Bulgaria. The account is used for the deployment of authorised capital prior to the company being registered in the Commercial Register.

⚠️ The cumulative account IS NOT a payment account and can’t be used for payments other than the authorised capital – incoming and outgoing.

What is the difference between a payment account and a cumulative account?

The cumulative account is only used for depositing the authorised capital when establishing a private company in Bulgaria. It can’t be used for payments other than the authorised capital – incoming and outgoing.

The payment account is suitable for your daily banking operations. It can be managed via online or mobile banking in real-time. The Visa card can be added to the account and used for cashless payments.

How to open a Paysera business account? See the video instructions here

Who can open a cumulative account?

The service is suitable for individuals, both Bulgarian and foreign citizens, who want to establish a private company in Bulgaria. The cumulative account can be opened by the future manager or company representative.

Steps for opening a cumulative account

- Opening a Paysera personal account

The future manager or company representative registers via the Paysera mobile app as an individual and fills out a Know Your Customer (KYC) questionnaire. To find out how to open a Paysera personal account and for useful information for new clients, see here.

- Service request

The service can be requested via email. The client receives a reply with information about the necessary documents they must provide. A list of the documents is available here.

- Document review

The submitted documents are reviewed and analysed. Additional questions about the company's activities are sent.

- Cumulative account opening and capital deployment

After approval, a cumulative account is opened in the Paysera system, where the authorised capital should be deployed. The client is issued a certificate for paid-in capital, with which the company is registered with the Registry Agency.

- Cumulative account closure and business account opening

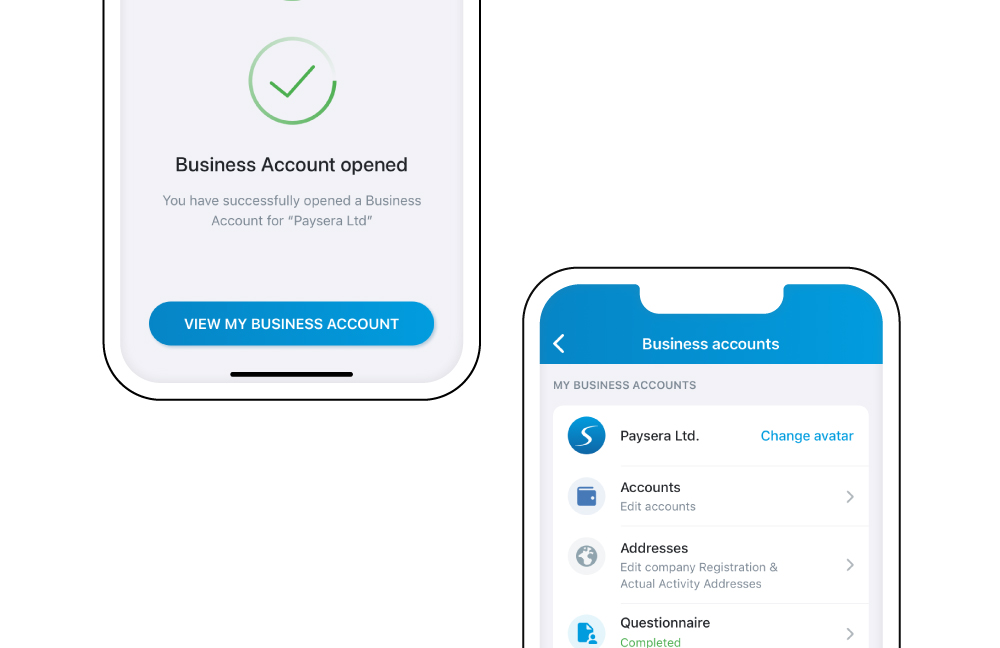

Following the registration of the company with the Registry Agency, the client follows the steps to open a business account. The cumulative account is closed and the capital is transferred to a newly opened payment account.

How much does it cost?

Check the fee for opening a cumulative account here.

Why choose Paysera?

⌛ Saves you time and money

With our digital services, you don’t need to waste time waiting in queues. Our client support team is available from 9 a.m. to 5:30 p.m. on business days. You can contact us via phone or email. With Paysera's competitively low fees for opening a cumulative account, you also save money.

📁 You get full support for the preparation of the documents

Our team will support you with the preparation of the required documents. After you request the service by email, we will send you information about the necessary documents you must provide.

💻 You have detailed information for each stage of the procedure online

You can request the service purely online. You don’t have to waste time waiting in queues, and you can receive information about the progress of the procedure online.

What should you know about Paysera business account?

You can open a Paysera business account for free, and it has no monthly fee. It has IBAN accounts available in BGN, EUR, RON, and HUF. And you can send and receive money in 25+ currencies.

You get a full transactional service – from fast international money transfers with good rates to currency exchange and budget payments. Manage your money via online or mobile banking at any time, wherever you are. If necessary, you can generate detailed bank statements as well as transaction reports. In addition, you have the option to activate notifications for incoming or outgoing transfers via email or SMS.

Paysera is much more than an online payment system. It is a modern, convenient, and cost-effective alternative to traditional payment services.

Open your multi-currency IBAN account for FREE!