Why is personal information requested?

Compliance requirements

Clients expect their financial institution to provide relevant and high-quality services, and ensure the security of their funds. To implement these aspects, financial institutions worldwide apply the Know Your Client principle, and we are no exception.

Acting according to this principle, we regularly request our clients to provide information about their financial activity and constantly update their personal data. This process is unrelated to any suspicions of criminal activity and is applied to all our clients without any exceptions. Collection of information helps ensure the security of your funds, data, and interests.

1. Country of birth.

To start, select your country of birth.

2. Information about activities.

Mark the activities that represent your current situation. Additional questions will appear when selecting certain activities.

If you select Employed or Student additional dropdown will appear, where the country will need to be chosen. If you are a freelancer, you will be asked to select the industry/specialisation you work as a freelancer. If you select Other, an additional text field will appear to write a description of the activity.

3. What are your relations with the European Union/European Economy Area countries?

This section appears to non-EU/EEA citizens. Based on your relations to EU/EEA you might be required to provide additional supporting documents to prove your status or employment.

4. Sources of funds.

Select the main source of funds you will be receiving in your account. Additional questions will appear when selecting certain sources of funds.

5. Services you plan to use.

Mark which services you plan to use. You can choose multiple answers or just one.

6. Planned monthly turnover.

Select the turnover you plan to have per month. For example, if you earn around 800 EUR and have no other sources of income, select up to 1,000 EUR.

7. Are you a citizen of more than one country?

In this step, simply choose Yes or No.

8. Participation in politics.

Indicate whether your job is related to politics – perhaps you work for the parliament, a political party, etc. Select Yes, if you worked in this kind of job less than a year ago.

The second question concerns your relatives and associates. Are any of them employed in political roles or hold significant positions within international or national institutions? Select Yes if they held such positions within the past year (for example, approximately eight months ago).

9. Who is the final beneficiary?

The final beneficiary is the account holder and the person who owns the money in the account. Please note that you can only open an account for your own use and not for the use of others.

- During registration;

- Approximately once a year for updating the information;

- If unusual activity is detected, a large payment is made, or in case of recurrent small transactions. In such cases, we may ask additional questions about the purpose of the transaction, the source of funds, etc.

The clients who fail to submit the requested data may in some cases no longer be able to use certain financial services.

The faster you reply to all our questions and submit the required documents and information, and the more details you provide, the sooner we will be able to execute your transfer, lift restrictions from your account, or simply give you full access to Paysera services.

We store the personal information of clients responsibly and do not use it for any other purposes unrelated to security.

However, we cooperate with law enforcement authorities that have the right to apply to financial service institutions and request information about a client’s financial activity.

Any more questions?

If your account was restricted or closed, or you want to know how to avoid this happening, read our post on security measures applied by us and many other financial institutions.

If you have further questions, contact the Paysera Client Support.

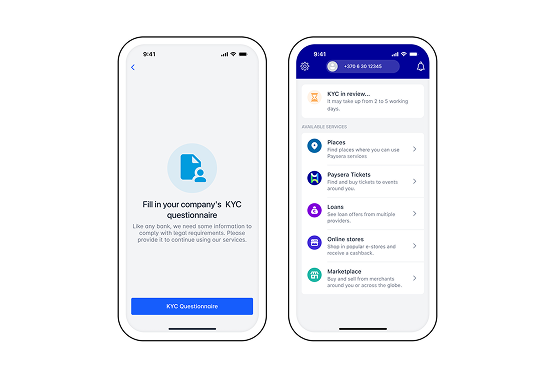

How to fill in the Know Your Client questionnaire?

How to fill in the Know Your Client questionnaire?  What data is requested?

What data is requested?

How often is data requested?

How often is data requested?  What happens if I don’t provide the information?

What happens if I don’t provide the information?  Which authorities can access my data?

Which authorities can access my data?  What’s important about KYC?

What’s important about KYC?