New Year’s resolutions: How to save money – the 50/30/20 rule

One of the most common New Year’s resolutions is better management of personal finances in order to buy something we dream of or to guarantee a more secure future for us. After spending our savings in the December sales, we often pull out our piggy bank in January. However, it doesn’t take long until we break our resolution. So how can we save money after all? And what is the 50/30/20 rule?

How to save money?

Saving money is one of the most common New Year’s resolutions. Even though quarantine has made this task slightly easier, many associate self-limitation with torture which leads to eventual submission.

Several tips for saving money:

🗂 Plan your expenses. Avoid impulsive and emotional purchases. Knowing exactly what you need will make it easier for you to resist promotions and avoid purchases that you may have never even considered.

🎯 Set yourself a goal. Saving for an indefinite period is hard. Set yourself a clear goal of what you need the money for – a trip, a new phone, or maybe it is a long-term goal and you are saving for your own place? Having set the goal, set a date until which you must have a certain amount saved. This way you will know an exact amount of money that you will have to set aside every month or every week.

Automate saving. Try to forget the amount you set aside every month as if you never had it. Setting aside a physical amount of money every time will be difficult, but using recurring payments will make it easier. If you have the Paysera mobile app and receive income to the Paysera account, you may select that a certain amount of money would be automatically transferred every month, on the day you receive your salary, to your account with the bank where you keep your savings, a Paysera account for savings, etc.

To select recurring payments, log in to the app and select > Transfers > Recurring Payments.

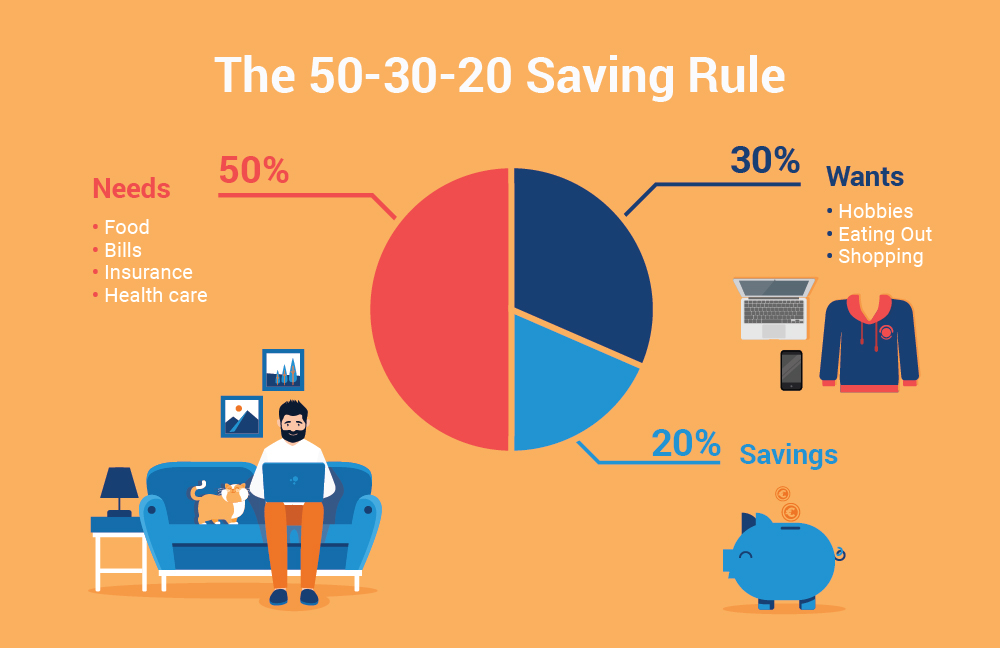

50/30/20 rule

One of the most common saving tips is to use the 50/30/20 rule. Even though it seems rather mathematical, it is very simple.

U.S. politician and expert in bankruptcy law Elizabeth Warren has popularized the 50/30/20 rule which means that 50% of your salary after taxes should cover your basic needs such as rent, food, bills, car maintenance, etc.

30% of your salary can be spent on other things such as clothes, hobbies, travelling, entertainment, and other purchases. While the remaining 20% should be allocated for saving.

It should be noted that these savings that make up 20 per cent of your salary are not short-term savings, e.g., for a computer, but the so-called savings for a rainy day.

If you are going to buy a computer, car, etc., you should set aside part of the money from the 30 per cent income intended for leisure and hobbies.

Of course, this 50/30/20 rule may not suit everyone, for example, people with low income may not be able to dedicate 30 per cent of their income to their pleasure, while those well-off may not spend all 50 per cent of their monthly income on their basic needs. However, the 50/30/20 rule is rather universal – we should set aside part of our money for savings every month so specifically this could be your New Year’s resolution.

Long-term savings

Long-term savings – for ten or more years – is an entirely different category of savings. Such savings are usually held by businessmen, well-off people, or simply people who are saving for old age, their children, or grandchildren.

However, long-term savings may depreciate in several decades because they, just like money in general, are affected by inflation. Thus, to preserve the purchasing power of their assets, people often keep their long-term savings in gold.

The price of gold changes every day, but the change is not dramatic, and, as a result, gold is not a popular form of investment because it does not generate constant income. However, in the long run, the price of gold increases alongside inflation. Thus, the majority of central banks across the world hold part of their money in gold.

If you have such long-term savings, you can buy investment gold without leaving your home – Paysera clients (you can become one for free) can purchase real physical investment gold at any time via the mobile app – both in small or in large quantities, in bars or coins. Purchasing gold is one of the more popular ways of long-term saving and probably one of the more unique New Year’s resolutions.

On the other hand, you can make your money work for you. In portals such as Savy you can lend your money to others and earn monthly interest. Gold and investment of money are just several ways of getting your money out of the piggy bank, where it is losing its value, while you are moving towards achieving your goal.

Other New Year’s resolutions 🏋️ 🥗 💸

Eating healthy, exercising, and saving money are some of the most common New Year’s resolutions that are made before the beginning of a new year. However, more than half of these resolutions are broken within the first month of the new year.

We often break resolutions because they are unrealistic, there are too many of them, and after failing to keep them, we give up for good.

However, there are a few easy ways to achieve your goals and develop new habits.

✅ Realistic resolutions. Do not demand too much from yourself because you will soon get tired, disappointed, and lose any motivation. Instead of promising to exercise every day, give yourself a few days off. However, do not relax too much. For example, if you promise to exercise more, but give yourself too much freedom, it will be hard to control yourself. Try promising to exercise 3–4 times a week.

🗣 Share your resolutions. Tell about your resolutions to your friends, relatives, or on social media – this way you will feel responsible not only towards yourself but also to others.

💪 Do not give up if you slip. If you slipped once, do not give up entirely. Try keeping your resolution – the fact that you skipped one day of exercise does not eliminate the progress that you have already achieved!

🧁 Motivational system. Reward yourself when you are doing great and discipline yourself slightly when you slip. For example, if you went on daily walks for a month, buy yourself a treat, new clothes, or a massage at the end of the month. If you break your resolution, promise to make 20 squats or set aside a certain amount to savings. This will help not only to keep this resolution but also to achieve other goals.

November 2020 • 4 min read

What is inflation and how to protect your money?

Inflation is happening constantly, everywhere, and affects everybody. Increasing prices of goods and decreasing purchasing power of money push companies and regular people to look for different ways to protect their money from losing its value. While some choose to invest, others go for safer alternatives.

Read more

November 2020 • 2 min read

Protect your money – go for gold!

A cup of coffee in the 1970s was 20 cents, today – it’s EUR 1.50. Meanwhile, an ounce of gold in the 1970s was EUR 200, today – it’s more than 8 times that price. What do these two commodities have in common, you may wonder? Inflation.

Read more

October 2020 • 4 min read

Gold purity, fineness, and karat – what is it and how to check it?

What do the numbers describing gold purity mean? What is the difference between karats and fineness? Can you find 100 per cent pure gold? And how do you check the fineness of gold?

Read more