Payment Initiation Service (PIS)

Payment Initiation Service (PIS) – a payment method based on an open banking system. It enables online buyers to pick their bank and, often without even leaving the payment window, confirm the payment for goods or services. It is a cheaper alternative to the previously popular Bank Link service.

Benefits of the Payment Initiation Service (PIS)

Reliable

The PIS checkout window is already known to many clients in Europe.

The PIS checkout window is already known to many clients in Europe. The PIS is licensed and regulated by the Bank of Lithuania.

The PIS is licensed and regulated by the Bank of Lithuania. Both the PIS provider Paysera and the banks guarantee the safety of clients' personal data and funds.

Both the PIS provider Paysera and the banks guarantee the safety of clients' personal data and funds. 24/7 client support in English.

24/7 client support in English.

Affordable

PIS fees – much lower than those of Bank Link, which is still a prominent payment processing method in e-shops.

PIS fees – much lower than those of Bank Link, which is still a prominent payment processing method in e-shops. Possibility to give up to 1% cashback to clients paying via their Paysera accounts.

Possibility to give up to 1% cashback to clients paying via their Paysera accounts.

Universal

Can be used together with Paysera Checkout in order to offer an even wider range of payment options – including accepting card payments and more.

Can be used together with Paysera Checkout in order to offer an even wider range of payment options – including accepting card payments and more. Possibility to check in the statements if the payment was made.

Possibility to check in the statements if the payment was made.

Convenient

Order and manage the service online.

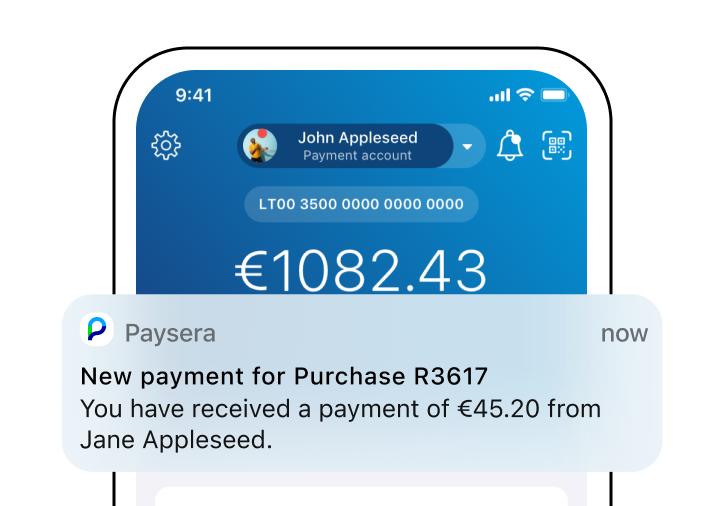

Order and manage the service online. Track payments in real-time in one place – your Paysera account.

Track payments in real-time in one place – your Paysera account. Offer popular payment methods to clients (via popular banks, including Swedbank, SEB, Luminor, Revolut, and so on).

Offer popular payment methods to clients (via popular banks, including Swedbank, SEB, Luminor, Revolut, and so on).

13 000+ e-shops use PIS

How does payment via PIS look like?

Payment steps may vary by bank.

How to start using the PIS?

In order to use all the benefits offered by PIS, the merchant must open a Paysera account and start accepting payments via Paysera.

If you are already using the Paysera payment gateway for accepting online payments and now want to switch to the payment initiation service and start saving money – you should select this method in your project settings in your Paysera account.

Log in to bank.paysera.com > Projects and Activities > My Projects > Project settings > Payment gateway service settings.

If you are already using the Paysera payment gateway for accepting online payments and now want to switch to the payment initiation service and start saving money – you should select this method in your project settings in your Paysera account.

Log in to bank.paysera.com > Projects and Activities > My Projects > Project settings > Payment gateway service settings.

PIS for non-e-commerce businesses

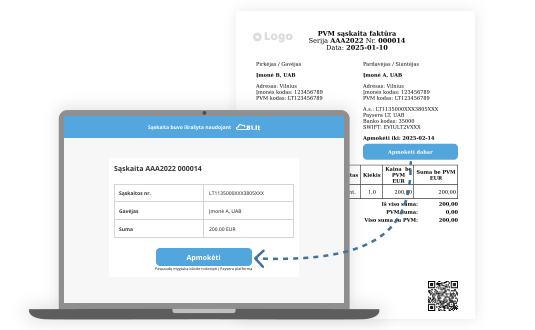

Site.pro solution – seamless integration of the Payment Initiation Service (PIS) for businesses without an e-shop. How does it work? Using the Site.pro program, the PIS function is activated before generating an invoice for payment. Once activated, an invoice is created with a special Pay Now button. With just one click, your customers are redirected to a payment page where they can choose their bank and complete the payment in just a few seconds.

Where does PIS work?

E-shop owners from many countries can use this method to accept online payments, since Paysera has integrations with almost 100 different banks in various countries. Meanwhile, buyers will be able to pay in your online store from all over the world.